Applying the Law of Conservation of Modularity to Buy Now Pay Later

Learning market analysis week 4 of 5

Last week’s class in the Divinations Market Analysis Workshop was heady. The main topic was The Law of Conservation of Modularity. It’s a mouthful to say and was more than I was able to wrap my head around during the 90 minutes of class time. So, when I sat down to write today’s entry (number 4 in this 5 part series), I needed to do some research. So off I went reading articles by Clay Christensen, and Ben Thompson and many other random internet people who have variously tried to retell the concept in their own words.

Then I got this feeling like I don’t want to be yet another person who goes on and on in a post to try to explain this complex idea. So I’m not going to.

Instead, I’m first going to share the simplest route to understanding. It’s these three articles in this order. You’ll understand the The Law of Conservation of Modularity in about 30 minutes:

Start by reading this really short, simple explanation of modular theory from the Christensen Institute. https://www.christenseninstitute.org/interdependence-modularity/

Then read Ben Thompson’s essay—it has the best diagrams to help explain how integrated parts of a market get modularized: https://stratechery.com/2015/netflix-and-the-conservation-of-attractive-profits/

Lastly, read Nathan Baschez’s essay which does the best job of explaining where market power lies (It has to do with the Basis of Competition): https://every.to/divinations/finding-power-432187

Now I’m going to keep writing, but below the divider I’ll assume you read the stuff above. If you’re like me, you’ll keep reading to see if you can follow me without doing the homework, and it will be a bit opaque but interesting enough that you’ll keep this tab open and come back to it when you have time to digest the prerequisites and then get the full value of the piece.

Applying the Law of Conservation of Modularity to fintech

Ok friends, here we are! The only people in this room are ones that already understand the Law of Conservation of Modularity. It’s such a complex idea that we can’t just put on our conservation of modularity glasses and instantly see the world through that lens. We have to painstakingly map and apply the law to every market we look at.

So let’s bring the Law of Conservation of Modularity to fintech. Specifically lets map it to eCommerce payments looking at the incumbent method, credit cards, vs an emerging method, buy now pay later (BNPL), and see what happens.

If this works, we should see an integrated part of the credit card payment value chain become modularized by BNPL, and we should also see that BNPL has its own integrated pieces of the value chain that might have been modularized in the credit card market.

Let’s start by looking at simplified value chains for each. They’re the same. With both credit cards and BNPL, the activities are to identify customers, assess their creditworthiness, get merchants on the platform, and then allow customers to buy stuff from the merchants. Finally, you have to service the loan that the customer creates by making purchases.

The current credit card payment landscape is super modularized. There are different companies involved in every nook and cranny providing more services than I’ve even bothered to list as activities in this value chain. But, as we learned from Nathan Baschez, the power in the market is held by whatever companies own the pieces that form the Basis of Competition.

With credit card payments, the Basis of Competition was traditionally ubiquity (“It’s everywhere you want to be”), credit limit, price of the credit, and rewards. Visa/Mastercard and Amex have modularized the ubiquity piece and own it. The credit limit, price of the credit and rewards were integrated and owned by issuing banks like Chase, Citi, and Capital One.

So if this Law of Conservation of Modularity is true, then for BNPL to compete with credit cards, it should modularize something that was integrated at the issuing banks, and integrate some other part.

Let’s work backwards from why people use BNPL to see if this is true. People use it because it slows down cash flow without simultaneously creating a compound interest accruing balance on a high interest loan. More simply put, they use it because it helps them afford stuff instead of either waiting and buying it later or facing an even higher wall of credit card debt to pay down.

So if you imagine that wall of credit card debt to be included in the stuff that card issuers had integrated, then BNPL is modularizing it. And it is! Traditionally, we didn’t get a single credit card for each new purchase because the process of underwriting and managing payments across all those credit cards would have been ridiculous. So BNPL modularizes (unbundles) the big loan into a bunch of little loans by better integrating and automating the application, underwriting, and loan servicing of a bunch of tiny loans. They have to pull merchant acquisition and onboarding, which traditional credit card companies had already outsourced to independent sales organizations (ISOs), back into their own functions in order to accomplish this.

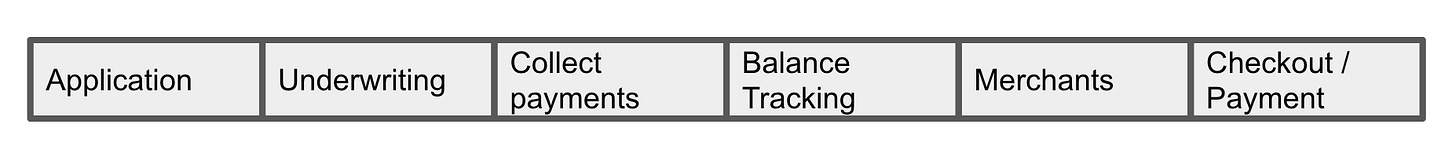

Here’s a diagram showing the shift from integrated to modularized parts. I’ve used “balance tracking” as shorthand for one big loan vs many little loans.

As BNPL grows, just like credit cards did in the past, they may look to outsource merchant onboarding and the payment experience, but they must hold onto underwriting and anything that provides purchase and borrower behavior data. The winner in this market is the one that can loan the most money to the most people without suffering business losses from credit defaults.

As the various BNPL companies vie for dominance, there will be a few that overextend themselves by loaning too much to people that can’t repay their loans, and the ones remaining will probably end up with fairly similar loan approval likelihoods for consumers—just like competing credit card companies have today. At that point, when purchasers are equally likely to be approved across a number of BNPL choices, then other factors like ubiquity, rewards, and user experience will become the basis of competition.

Thanks for reading this installment of my series on the Divinations Market Analysis Workshop. For people that have been reading Startup Win! since the beginning, you’ve probably noticed that I have devoted more words to fintech in recent entries. This trend will continue and I might even change the name of the newsletter to clarify that my focus will be on fintech startups. This narrowing of focus coincides with Kelsus’s narrowed target market.

We’re enjoying expanding Kelsus into the European fintech market, so if you work at a European fintech or know people that do and want to talk about ways to improve your product market fit using these market analysis techniques, please get in touch.

Thanks,

—Jon Christensen